Apple Stock Faces Volatility as Trump Tariffs Spark Market Uncertainty

The Drop in Apple Stock

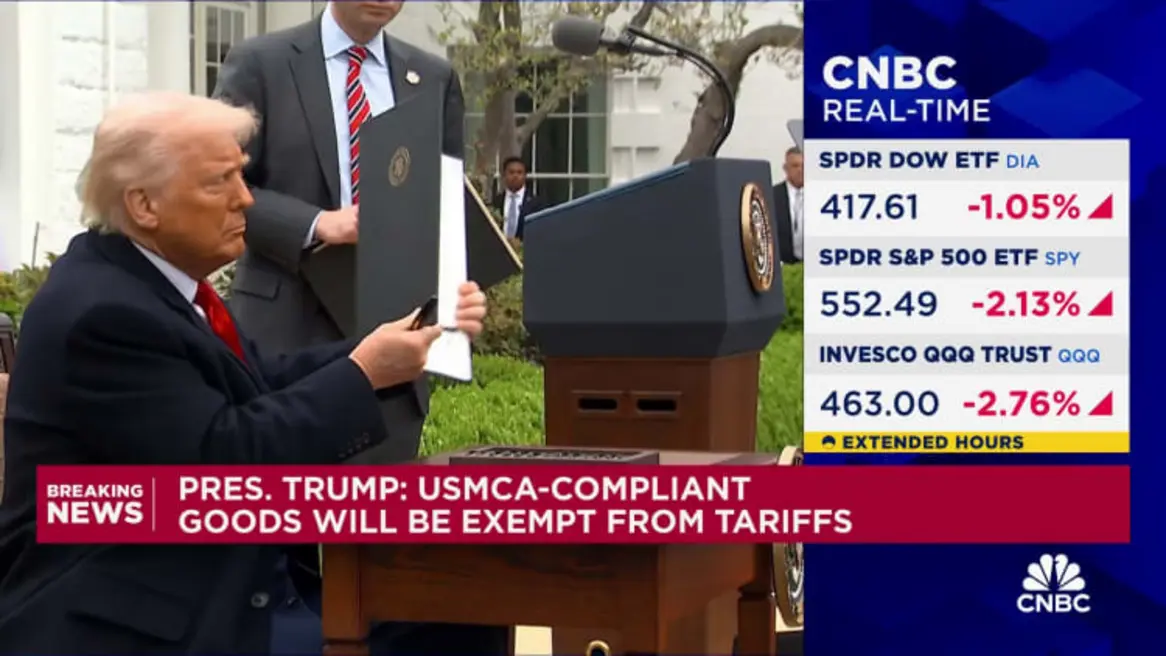

Shares of Apple Inc. (AAPL) have taken a nosedive following the announcement of U.S. President Donald Trump’s new tariffs on imported steel and aluminum, which could have far-reaching implications for global trade relations.

What Happened with Apple Stock?

Apple stock dropped significantly after Trump’s tweet outlining his new tariffs last week. The tech giant is a key player in the global supply chain, particularly reliant on components imported from countries like China. This has made it highly sensitive to trade policies and international market movements.

How Tariffs Impact Tech Stocks: A Broader Economic Context

The Impact of Tariffs on Global Trade

Trump’s new tariffs aim to protect U.S. industries from foreign competition, which could lead to higher import costs for goods across the globe. This includes technology products and components that Apple imports. Such measures can create uncertainty in global markets.

Supply Chain Concerns and Product Pricing

Apple sources a substantial portion of its components from China, where it is a major employer with significant investments. The impact of tariffs on Chinese exports could directly affect Apple’s supply chain and product pricing strategies.

Tech Sector Reaction: A mixed Bag for Investors

The tech sector has been hit hard by the U.S. administration’s trade policies. Companies like Alphabet (GOOGL) and Meta Platforms (META) have also seen their stocks fall, signaling a broader market reaction to protectionist measures.

Long-Term Considerations for Tech Stocks

While immediate stock drops are understandable due to short-term geopolitical tensions, long-term investors should consider the broader economic context. Tariff policies may signal structural changes in international trade that could influence tech companies’ global expansion and profitability.

Conclusion: Staying Ahead of Market Volatility

As Trump’s tariffs continue to shape global markets, tech stocks like Apple are likely to face continued volatility. Investors should remain vigilant on geopolitical developments while diversifying their portfolios to mitigate risks associated with market uncertainty.

Stay informed on how trade policies evolve and its impact on key companies as we navigate the ever-changing global economic landscape.